3D Secure transactions

Overview

3D Secure provides an extra layer of protection for your business and customers for their online purchases. 3D Secure deters unauthorised card use and helps you to reduce fraudulent activity and chargebacks.

3D Secure stands for Three Domain Secure, and is the payments industry standard for secure online credit and debit card transactions. It requires your customers to authenticate themselves with their card issuer when purchasing online, proving that they are the legitimate cardholder. Customers authenticate themselves via Strong Customer Authentication (SCA), which is a two-factor authentication process. They must provide two of the following three factors:

- A knowledge factor - something only the customer knows, such as a password or PIN.

- A possession factor - something only the customer has, such as a mobile phone number or email address.

- An inherence factor - something the customer is, such as a fingerprint or facial recognition.

The benefits of complying with 3D Secure include:

- Reducing the risk of fraud and chargebacks.

- Shifting liability for chargebacks from you to the cardholder's bank.

- Increasing customer trust and confidence in your business.

How 3D Secure works

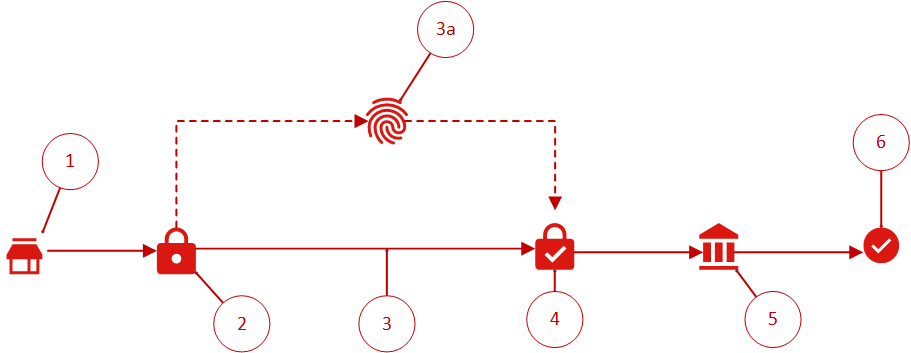

The following is an example of how authentication works with 3D Secure:

-

Customer makes a payment on your website.

-

By default, OnlinePay uses 3D Secure to authenticate the transaction.

-

In most cases, the 3D Secure process is invisible to the customer.

3a. However, if the transaction is deemed high risk, the customer may be challenged to authenticate themselves using a one-time password (OTP) or biometric data (e.g. fingerprint or facial recognition).

A high-risk transaction may include:- A large transaction amount.

- A transaction from a different country than the cardholder's usual location.

- A transaction from a new device or browser.

-

Once the transaction is authenticated with 3D Secure by the card issuer, the payment is sent to the cardholder's issuing bank for authorisation.

-

The issuing bank checks the transaction against multiple data points. If everything is in order, the bank authorises the payment.

-

Payment is processed and the transaction is complete.

Updated 8 months ago